EAA Investor Relations

EAA tapped the capital market again

- EAA meets its funding plan for 2017 with a 3 year benchmark in the size of 1 bn USD.

On 9 November 2017, EAA has placed its third benchmark bond for 2017 on the international capital market. The issue met a demand of beyond 1.6 bn USD in the orderbook, while in the forefront the size had been capped at 1 bn USD in accordance with refinancing needs. Investors were split into 47 % official institutions, 41 % banks and 12 % asset managers. At a spread of +15 bp versus mid swaps EAA once more availed itself of its excellent acceptance by the market.

Including this transaction EAA has raised an equivalent of about 3 bn EUR in line with its annual funding plan. Beyond that, short term liquidity is covered by commercial paper and other money market business.

For the following years EAA will continue using its global commercial paper programme for ensuring short term liquidity needs. Concerning future term funding, where maturities are rather to be expected between 2 and 3 years, the strategic planning suggests an annual volume of 3 bn in EUR equivalent, again. Here the focus will be on issuance in USD, which answers to the composition of currencies on the asset side and an overhang from past issues in EUR. As EAA assumes to best serving issuers demand with liquid bonds, the expected volume for 2018 will most likely be targeted with 2 or 3 benchmark transactions.

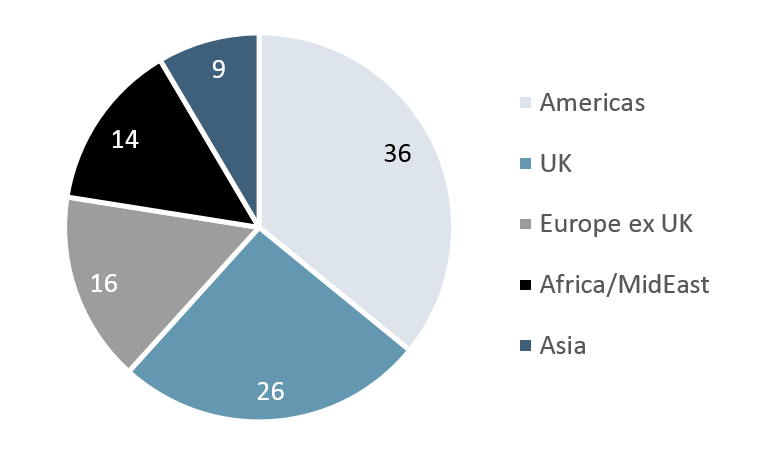

Distribution by region